Tariff rules across global markets are constantly changing, often without warning. For exporters, importers, and logistics teams, these shifts can lead to costly penalties, delayed shipments, or even full cargo rejections. If your business handles cross-border trade, tariff compliance is no longer optional—it's a competitive advantage.

This guide explains how to stay compliant with rapidly changing tariff rules in 2025. From HS code validation to trade agreement documentation and forwarder partnerships, we outline actionable steps to help you mitigate risks and avoid fines.

GeeseCargo works with clients across North America, Europe, and Asia to help them respond quickly and accurately to tariff policy updates. Let us show you how we keep international shipping safe and cost-efficient—regardless of what the customs codebook says tomorrow.

What Are the Most Common Tariff Compliance Mistakes?

Even experienced exporters sometimes slip up when it comes to tariffs.

The most common mistakes include using outdated HS codes, failing to provide origin certificates, underdeclaring values, and misunderstanding local duty exemptions.

Are You Still Using Obsolete HS Codes?

Every 5 years, the World Customs Organization updates the Harmonized System (HS). Many businesses forget to align their product categories with these revisions. A wrong code can trigger audits, delays, and penalties.

Use tools like WCO Trade Tools or TradeMap to verify that your product HS codes are up to date.

Are Certificates of Origin Accurate and Complete?

A missing or incorrect Certificate of Origin can disqualify you from Free Trade Agreement (FTA) benefits. Some exporters use generic forms or incomplete supporting documents, triggering full tariff rates instead of reduced ones.

Working with experienced freight partners ensures your COs match legal requirements under deals like RCEP or ASEAN-China FTA.

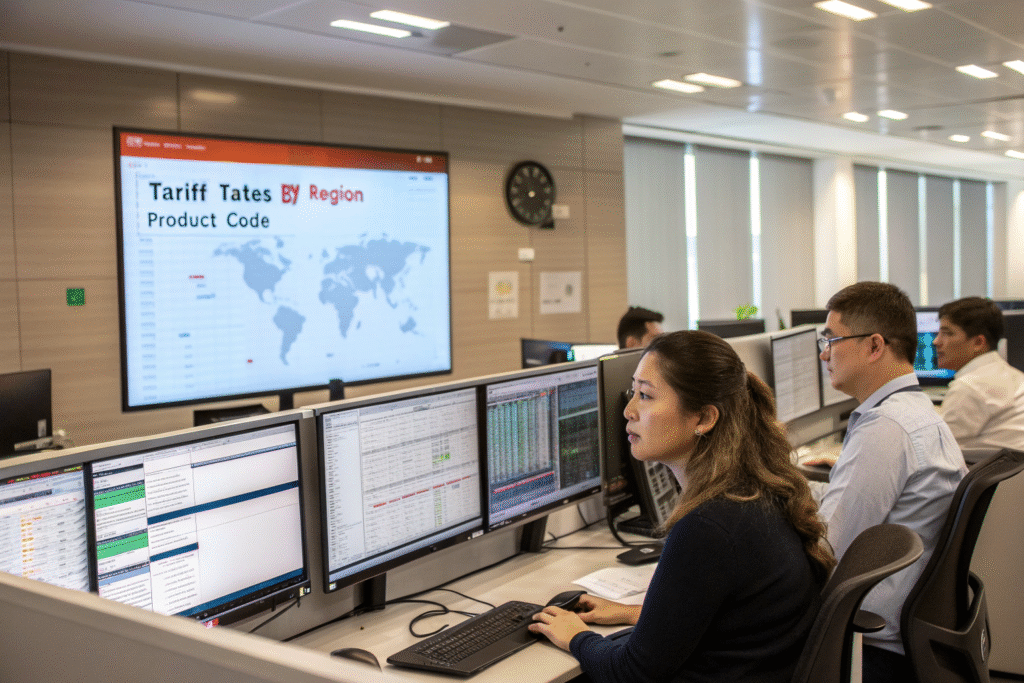

How to Monitor Tariff Policy Changes in Real Time?

By the time tariff news hits headlines, your shipment may already be en route.

Smart businesses rely on real-time monitoring tools and freight partner alerts to stay ahead of the changes. Customs changes often happen quietly—until your cargo is held up.

What Tools Help You Track Duty Changes?

Digital platforms like Flexport, Kuehne+Nagel SeaExplorer, or our own GeeseCargo internal alert system monitor changes in:

- Import duty rates

- Trade remedy updates

- Preferential tariff changes

- Export rebates and restrictions

Set keyword alerts for tariff terms from official sites like WTO or USTR.

Can Freight Forwarders Notify You in Advance?

Absolutely. We notify clients as soon as tariff changes are announced. In urgent cases, we can reroute or reclassify goods, or delay shipments until paperwork is corrected.

Many importers rely on us for proactive notifications—especially for volatile destinations like the U.S., Indonesia, and the EU.

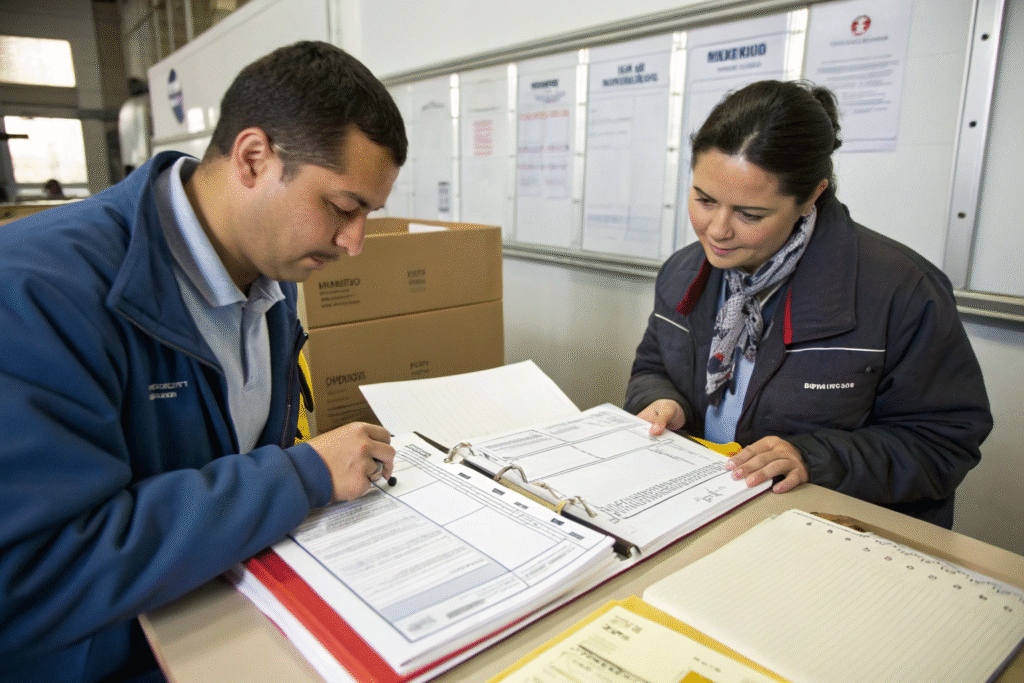

What Documentation Keeps You Safe at Customs?

Proper documentation is your first defense against customs delays or fines.

Each shipment should carry a customs-ready file including invoices, classification references, country of origin proof, Incoterm terms, and any preferential tariff certificates.

What Is a “Customs-Ready” Documentation Set?

It includes:

- Commercial Invoice with clear product details and Incoterms

- HS Code Justification Sheet using WCO notes

- Certificate of Origin (COO) that aligns with FTA terms

- Packing List with product breakdown

- Shipping Contract or Bill of Lading

Templates for compliant customs docs are available at Alibaba Documentation Guide and ITC Export Documentation Library.

What If You’re Using Third-Party Fulfillment Warehouses?

If your goods are shipped through warehouses like Amazon FBA or 3PLs in the U.S., ensure you pre-upload documents to their systems. Misfiled or delayed uploads can mean weeks of hold-ups at customs inspection points.

Check Amazon Global Logistics or contact your 3PL to understand exact doc formats.

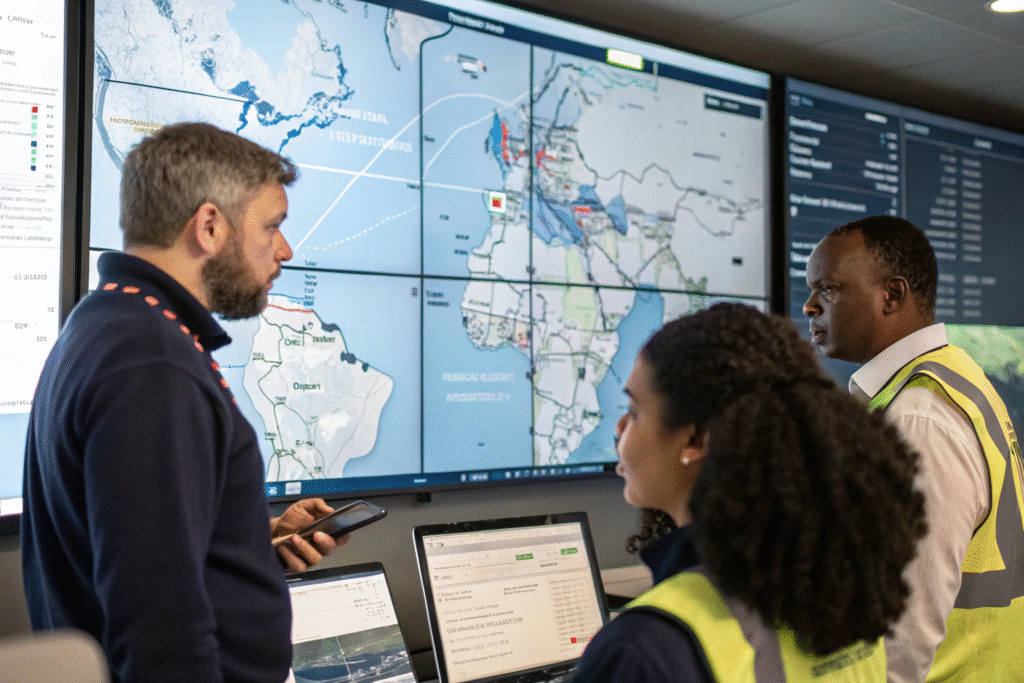

Why Freight Forwarders Are Key to Tariff Compliance?

Freight forwarders don’t just move your goods—we protect them from unnecessary cost and risk.

With daily customs interactions, forwarders like GeeseCargo know what causes rejections, audits, or extra duties. We act as your compliance team on the ground, especially in Asia, Europe, and the U.S.

Can Forwarders Help With Advance Ruling Applications?

Yes. If a product’s HS code is unclear, we assist clients in filing for binding advance rulings from customs authorities. This avoids disputes later at the port of entry.

Some countries—like Canada, Australia, and the U.S.—encourage advance rulings to pre-classify goods.

How Do We Help Clients Navigate Sudden Tariff Surges?

We run landed cost simulations. If Indonesia raises duty from 5% to 19%, we simulate the new landed price. Then we propose:

- FOB shipping instead of DDP

- ASEAN route adjustment

- Shipment delay by 3 days until new COO is issued

You can test this using GoComet’s cost calculator or consult GeeseCargo for custom simulations.

Conclusion

Tariff rules are no longer just a tax—they're a moving target. If you rely on cross-border shipping, staying compliant is the only way to protect your margins and reputation. Start with accurate HS codes, document discipline, real-time tracking, and forwarder partnerships you can trust.

GeeseCargo helps buyers, brand owners, and sourcing agents across Asia and North America stay compliant and cost-competitive. To review your tariff exposure or get help organizing a compliant logistics flow, reach out to Ben Zhu at benzhu@geesecargo.com. We make tariff complexity easy to manage.