Import taxes are one of the biggest hidden costs in global trade. In 2025, with new tariffs affecting everything from apparel to electronics, smart importers are looking for legal ways to reduce tax liability—without risking customs violations or delivery delays.

This guide shows the most effective and legally compliant ways to reduce import duties in 2025, using real strategies like HS code accuracy, trade agreements, bonded storage, and invoice optimization.

If you're moving goods across borders and want to protect your margins, these tactics will keep your shipments compliant and your landed costs under control.

Are You Using the Right HS Code?

HS (Harmonized System) codes define how your goods are classified—and directly impact how much duty you pay. Small errors or lazy classifications can cost importers thousands in unnecessary tariffs.

The right HS code ensures you're paying the correct rate—often much lower than default codes used by suppliers or freight agents.

What Are Common HS Code Mistakes?

Many importers:

- Use the supplier's code without verifying it

- Apply general categories instead of specific sub-codes

- Overlook changes in country-specific duty schedules

Use the WCO Harmonized System Tool or your national tariff schedule (like HTSUS for the U.S.) to check exact classifications.

How Can HS Code Optimization Save You Money?

A cotton T-shirt may be taxed at 8%, while a blend could qualify for a 0% FTA rate. Similarly, misclassifying electronics as accessories might lead to higher customs scrutiny and delay.

At GeeseCargo, we offer pre-clearance audits to correct HS codes—often reducing duties by 5–15% per shipment.

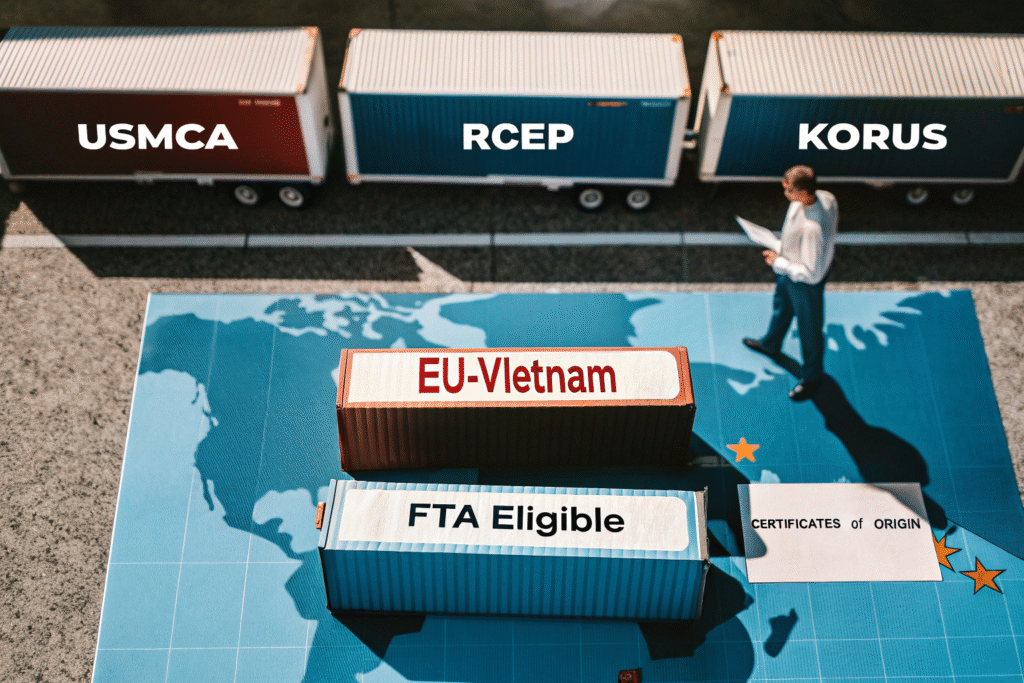

Have You Leveraged Free Trade Agreements?

Free Trade Agreements (FTAs) are powerful tools to reduce or eliminate duties—but many importers overlook them due to missing paperwork or supplier non-compliance.

Using the right FTA can drop your duty rate to 0%, provided your product meets origin criteria and paperwork is filed correctly.

What FTAs Should You Use in 2025?

- USMCA for North America

- RCEP for trade with China, Japan, and ASEAN

- EU-Vietnam for textile and electronics

- KORUS for U.S.–Korea shipments

Use the U.S. FTA matrix or European Commission FTA guide to verify applicable routes.

How Can You Qualify for FTA Benefits?

You need a valid Certificate of Origin (COO), correct HS code, and supplier documentation proving origin compliance. GeeseCargo helps coordinate COO collection, review content, and ensure it’s paired with the right shipping documents.

Have You Considered Bonded Warehousing?

Bonded warehouses allow you to store goods without paying duty upfront. You only pay tax when the goods enter the local market—or not at all if you re-export.

Bonded storage is ideal for e-commerce, seasonal stock, or distributors with multi-country fulfillment.

Where Are Bonded Zones Most Effective?

- China (Yiwu, Ningbo, Shenzhen)

- Thailand (Laem Chabang)

- Vietnam (Hai Phong, HCMC)

- U.S. (Los Angeles, Chicago, Savannah)

Use bonded warehousing to delay taxes, consolidate shipments, or change labeling before local distribution.

How Does GeeseCargo Use Bonded Strategies?

We help clients store goods temporarily, handle all customs entries, and assist with deferred tax payment until inventory is sold. For re-exporters, we often help them pay 0% local duty.

Are You Structuring Your Invoice to Lower Duties?

Duty is calculated on declared value—so how you structure your invoice can dramatically affect the tax base. Many importers unknowingly inflate their duty costs with vague or bundled invoices.

Separating freight, insurance, and non-dutiable charges on invoices can legally reduce the duty base.

What Are Non-Dutiable Costs?

Depending on the country, non-taxable items may include:

- Design royalties

- Molding or tooling fees

- Inland trucking

- Packaging and testing

List these separately to avoid them being included in the taxable base.

Should You Invoice as FOB or CIF?

In countries like the U.S., FOB is often preferred, as only the product value is taxed. With CIF, customs will also tax shipping and insurance.

At GeeseCargo, we help clients structure invoices to comply with destination rules and minimize declared value risk.

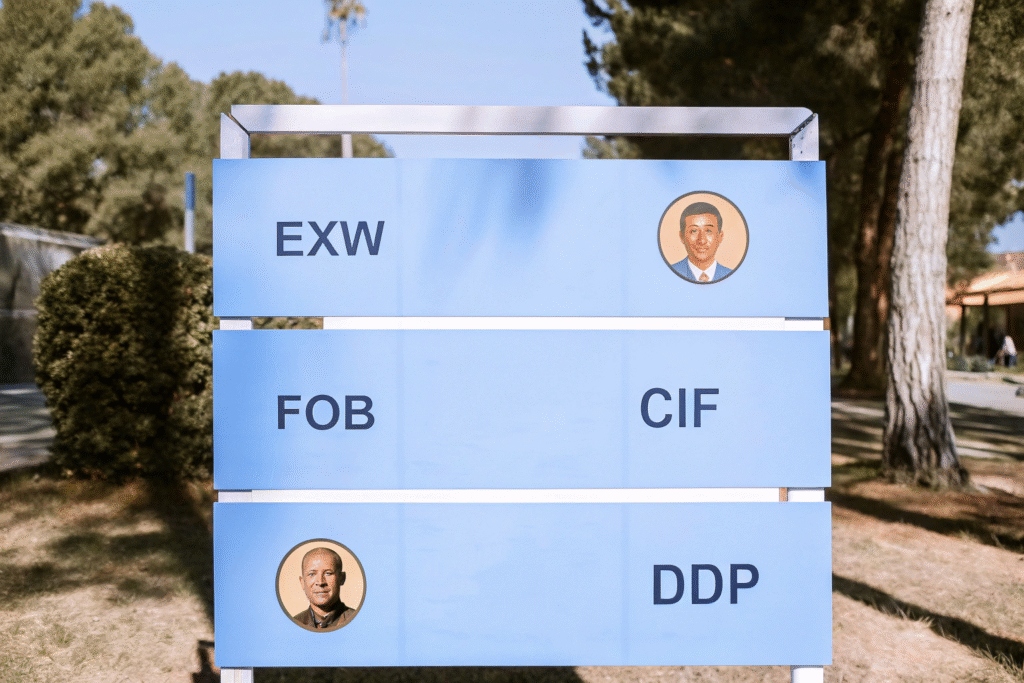

Are You Using the Right Incoterms to Control Taxes?

Incoterms aren’t just trade language—they define who’s responsible for duties, customs, and clearance. Choosing the wrong term can expose you to surprise import tax liability.

Using DDP (Delivered Duty Paid) provides full cost visibility and compliance across borders.

When Should You Use DDP?

DDP is ideal when:

- You want to avoid customs paperwork

- You need a clear landed cost for resale pricing

- You ship small parcels via e-commerce platforms

With DDP, we handle all duties, taxes, and customs formalities. You just receive the goods—ready for sale.

What About EXW or CIF?

EXW shifts all burden to you (importer), often leading to confusion and delay. CIF includes freight and insurance in duty calculations, raising the taxable base.

GeeseCargo helps clients choose Incoterms that align with cost, control, and tax impact for every shipment.

Conclusion

Reducing import taxes doesn’t require tricks—it requires better planning, correct documentation, and smarter logistics decisions. With HS accuracy, FTA usage, bonded warehousing, and proper invoice structuring, you can cut your duty bill significantly and stay compliant.

At GeeseCargo, we help importers apply these strategies to every shipment. If you're looking to legally lower duties and control landed cost in 2025, contact Ben Zhu at benzhu@geesecargo.com to receive a customized plan.